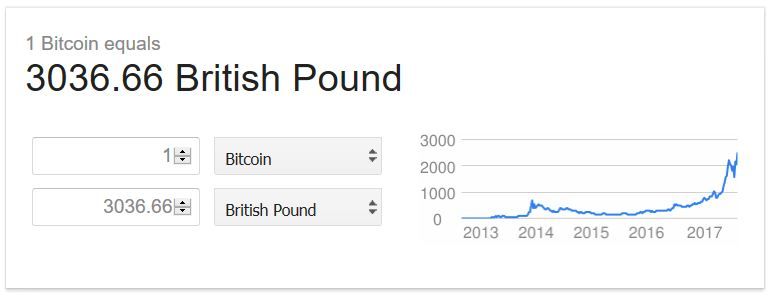

Posted by Neil Wyatt on 14/10/2017 23:49:58:

I'm not arguing about the technical implementation, the security or anything else like that.

I just think that bitcoin is a currency that's being treated as a commodity.

That's exactly how gold was used in the days of the gold standard, but then gold started to get too rare…

Now you will argue that when bitcoin gets scarce you can always 'mine' more so it won't run out; but the limited supply of gold was what supported its value. As Moore's Law bites and it gets easier and easier to make bitcoin its value will, if not decline, slow down.

But the key point is as bitcoin becomes really widely traded and transferable its value will start to be determined not by investors but by its real purchasing power, but unlike currencies that are underwritten by nation states or stocks backed by companies, bitcoin is more like a derivative with no tangible real value other than the fact that everyone who has invested in bitcoin wants it to have worth.

When bitcoin starts a real slide (rather than its minor hicups to date) the World Bank isn't going to step in to underwrite it, nor is anyone else. You can bet eth likes of Paypal will be the first to jump ship and the value will just slide…

That's when they nip round the back, not to wipe it out, but to neuter it; probably by creating a some new, regulated alternative and offering you to sell your bitcoin for the new alternative or watch your investments dwindle to junk…

I bet the 'bitcoin alternative' is already set up and ready to roll…

Neil

(All speculation based on my shaky knowledge of economics but let's see what happens by 2020!)

I wouldn't argue that more could be mined, because I know it's part of the protocol that production of coins is capped at 21 million. This figure is unalterable and is what makes the supply limited in a similar way to that of gold. Each bitcoin is divisible to eight decimal places.

When talking about Bitcoin, Moore's Law becomes irrelevant because the protocol regulates the mining difficulty to change in proportion to processing power. This means that the time between mined blocks stays fairly close to ten minutes. The number of bitcoins produced currently is 12.5 per block and is halved every 210000 blocks (approx four years). The last fraction of a bitcoin will be mined around the year 2140

Venezuela, Zimbabwe, Cyprus and Greece had currencies underwritten by their governments, but still suffered either hyperinflation or bank bail-ins.

There may be government cryptocurrencies in the future, but no one can be compelled to use them. Why would I choose to use a bank/government generated currency that can be seized, frozen, bailed-in or have a negative interest rate applied to it when I can have a trustless alternative that gradually increases in its purchasing power?

not done it yet.