Posted by Henry Brown on 06/01/2021 12:21:07:

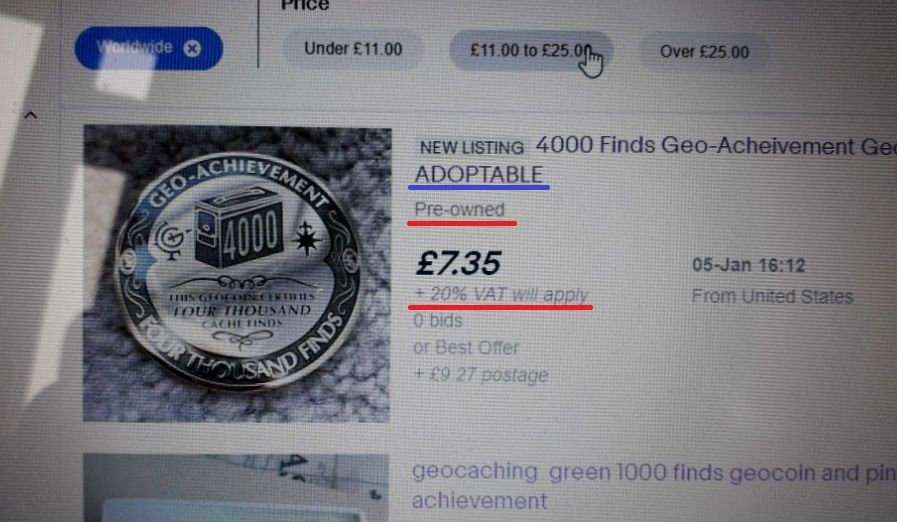

It seems ebay aren't up to speed yet! Here's a listing for a used geocoin, it has to be used because not only does it say pre owned it is also "activated" (the coin has a trackable number that the owner activates to allow it to be tracked as it travels the world). The listing clearly shows that VAT will be added. Maybe the seller in the US doesn't know about the VAT changes here and has set his listing wrongly but I'd have thought ebay would have picked that up from the pre owned statement.

I might be missing something here, but surely this is correct.

If you tailor your search, in such a way that a variety of similar items are shown world wide, and then index on most recently listed, everything from outside the UK, that was listed post Brexit, shows VAT to be added.

I've only tried it specifically for Geo Achievement Geo-coin.

Ebay don't seem to have retrospectively acted on listings which were active pre Brexit (which I think may be correct anyway – I'm not sure about that)

I think I've got the following about right;

Post Brexit, we have removed the lower value VAT threshold for imports and made it zero.

For items <£135 which are subject to VAT, the VAT should now be collected at source from the seller.

On-Line Marketplaces (OLMs) can/must(?) take over this collection on behalf of the seller.

Items >£135 it's collected at the UK end. (I can't remember how that works with OLMs)

This electronic coin isn't classed as VAT exempt, whether new or used, (it's used, but not an antique) and is for sale from a private seller via ebay (an OLM) At the moment, the bidding price plus postage hasn't exceeded £135

Ebay collects VAT, on behalf of seller, and submits it direct to UK HMRC ( or in a few months time, to the relevant EU tax authority if an EU buyer wins the auction)

If that seller was dealing with you (in the UK) directly, not via ebay, they would still be responsible for the UK VAT under our new taxation laws.

They would have to fill in the relevant US customs documentation, and I think the VAT would be handled via their chosen courier, for which they would be charged an admin fee. (This is still assuming sub £135)

An overseas business seller sending you the item directly, would have to follow a similar path (I think), or could register their business directly with UK HMRC, for which they would be charged a fee.

They could then directly remit the VAT to HMRC, but are responsible for keeping records of all transactions for six years (I've no idea how this will be audited).

An overseas business seller selling to you directly if you have a registered VAT number with HMRC yourself, can ask you for that number and use it for payments.

I'm using the term "Overseas" loosely here, meaning Non UK, but excluding NI.

It gets more complicated for imports to N Ireland, which I've not explored; this has addled my tiny brain sufficiently as it is.

Bill

Henry Brown.