Posted by John Hinkley on 08/01/2021 09:28:43:

I'm not sure whether this will add anything to the discussion or muddy the waters further, but …

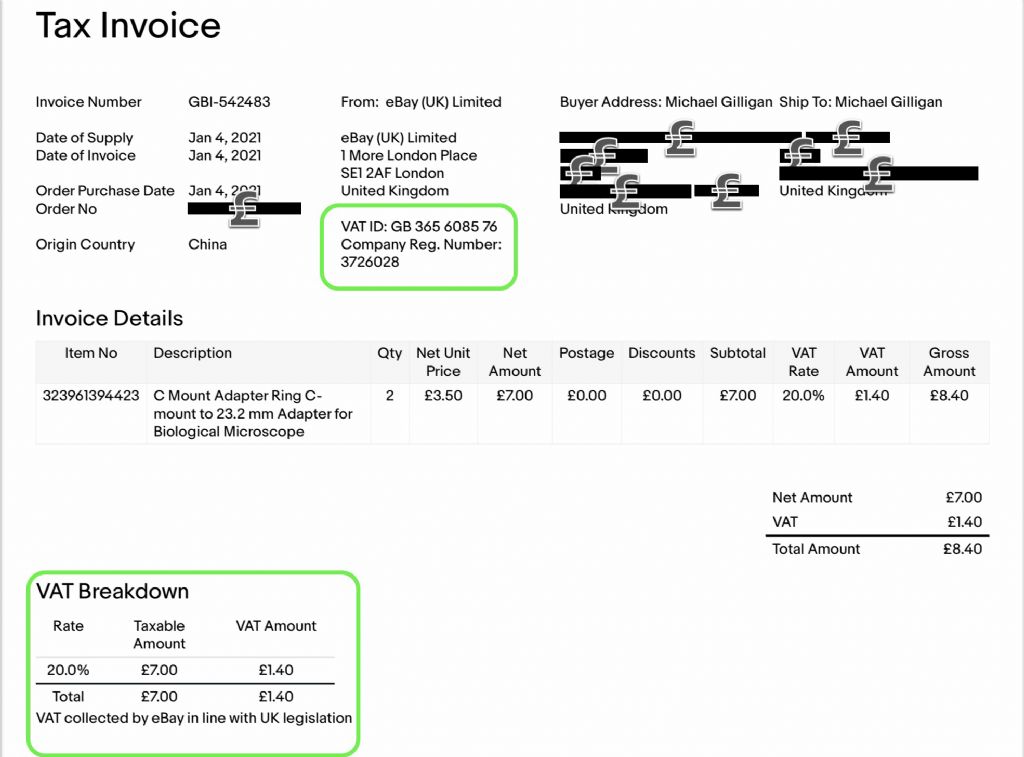

…The message from ebay, confirming my order,received just after I placed the order, stated that… "20% VAT will apply". Checked my PayPal account and £59.84 had duly been paid to the seller. The item has been dispatched today and it remains to be seen when or if the VAT will be collected and by whom.

…

Good experiment, but I think it will have to be repeated later in the year.

At the moment the tax changes are in transition. No-one – whether customer, supplier or HRMC – has had time to understand and make all the necessary changes. Ebay need to change their computer system and/or foreign suppliers have to register for VAT, find out how to pay UK tax and HRMC have to organise to receive the money and check payments against goods received.

As sorting out the details will take time and early transactions are likely to be riddled with errors, the government has decided to relax checking at this stage. The new rules don't apply in full yet.

I think John's purchase shows the new system starting up, but not operating as intended yet:

- ebay have told the customer VAT applies, but haven't collected it (as far as I can see). This warns the customer that tax is due and collection might be enforced.

- It's possible that the Chinese supplier is up and running VAT-wise, and the tax will be paid by them. Unlikely!

- The UK system for collecting unpaid VAT on postal imports is operational, so John might be asked to pay VAT plus handling charges on delivery. I say might because this system has always been applied haphazardly in the past, and it may have been temporarily relaxed.

As the world gradually adapts to the new system we can expect the rules to be enforced step by step. I predict John won't be charged VAT on delivery this time, but buying the same in June, or next year will be expensive because the purpose of the new system is to discourage tax dodging.

Since VAT is a tax on the customer, we can expect many items to cost more in future, whoever collects it. But it's only what we should have been paying in the past. Same tax obligation, it's just that the system has been changed to tighten the net. (In theory grey imports are discouraged and more tax raised. How well it works in practice remains to be seen! I think it's quite clever. )

I've no idea how long a major change like this will take to settle – could be years. In the meantime expect to see posts from people reporting 'no-problem' whilst others have to pay extra. Don't be baffled – there's an element of risk. A package might fly through the system without being checked as most do, or it could be one of those randomly inspected.

Although it's not been mentioned, a fairly obvious improvement once tax collection has been moved abroad is for senders to add a unique HMRC tax-paid code to the label, for scanning by postie in the UK. Then VAT collection in the UK becomes simple – no tax-paid code on a foreign package means it should be inspected.

Dave

Jonathon Bywater.